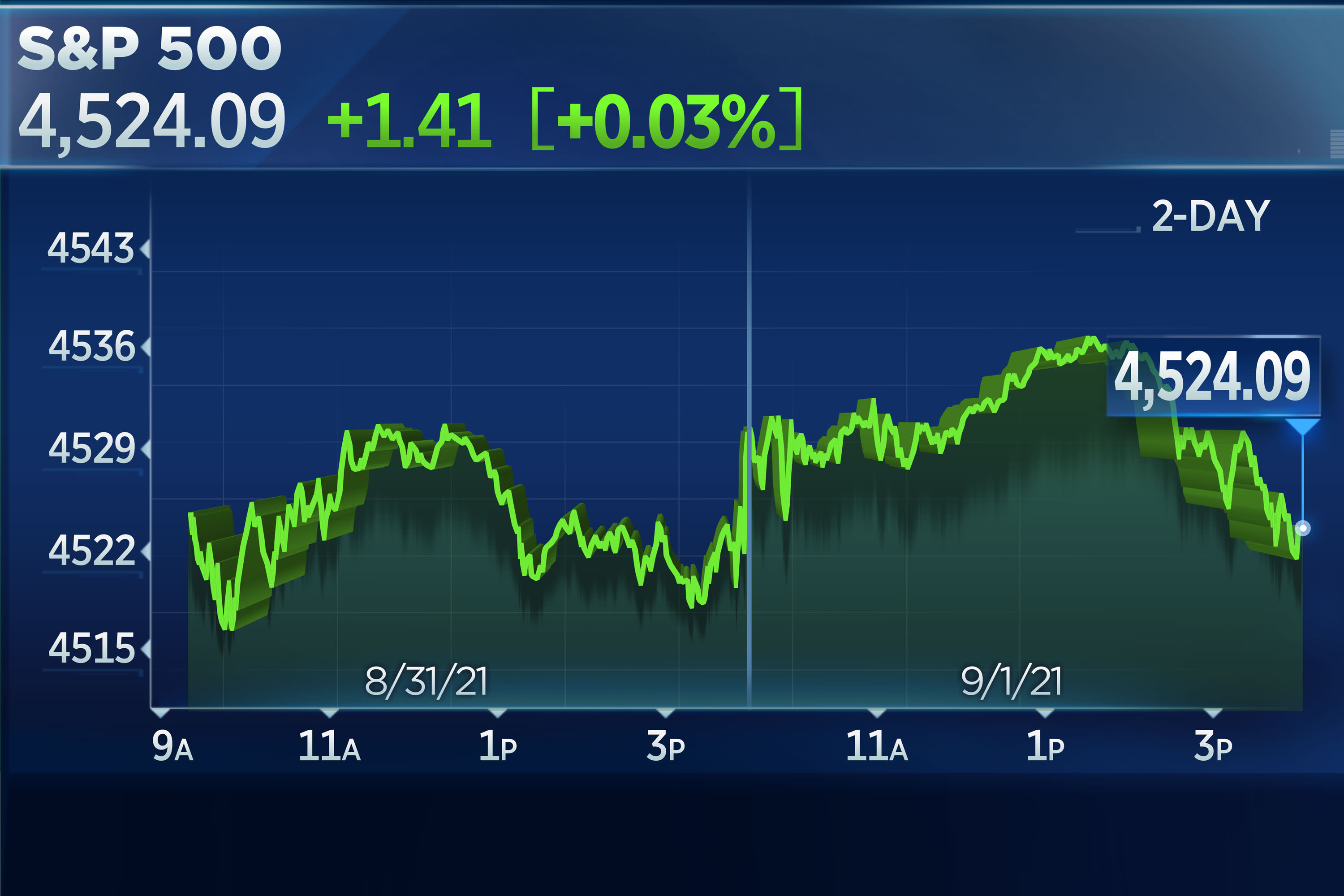

The S&P 500 closed the first trading day of September near the flatline as the strength in technology shares faded, while investors digested a disappointing employment report.

The broad equity index gained just 1.41 points on Wednesday to 4,524.09 as losses in energy offset gains in utilities and real estate. The tech-heavy Nasdaq Composite advanced 0.3% to 15,309.38 to eke out a record close after trading 0.8% higher earlier in the day. Apple jumped as much as 2% to an all-time high, but pared gains to about 0.5%. The Dow Jones Industrial Average dipped 48.20 points, or 0.1%, to 35,312.53.

U.S. companies created far fewer jobs than expected in August, with private payrolls rising just 374,000, according to payroll services firm ADP. That was well below the Dow Jones estimate of 600,000.

"With so much pressure on improvement on the labor market front coming from the Fed, this could send a signal that jobs growth is stagnating," said Mike Loewengart, managing director of investment strategy at E-Trade. "That's likely a good thing for the markets though as it means easy money policy continues."

The ADP report is a precursor to the official August U.S. non-farm payrolls data, which will be released Friday. Economists polled by Dow Jones expect 720,000 jobs were created in August and the unemployment rate fell to 5.2%.

Among individual equities, solar stock Sunrun surged more than 6% after JPMorgan predicted a comeback that would take the shares 90% higher.

Zoom Video shares rebounded slightly following a 16% plunge Tuesday after Cathie Wood revealed she bought nearly 200,000 shares on the dip.

The major averages just wrapped up a winning August. The S&P 500 rose 2.9% for the month, posting its seventh straight positive month and its best winning streak since 2017. The Nasdaq Composite gained about 4% for its third positive month and while the Dow lagged, it still added 1.2%.

The S&P 500 has had a pretty smooth ride so far in 2021, up more than 20% without even a 5% pullback. The benchmark has closed above its 200-day moving average, a measure of the long-term trend, for 296 days in a row.

So some strategists are on the lookout for a correction in September given that stocks haven't had a significant one since last October, combined with the highly anticipated meeting of the Federal Reserve Bank in September and the continued worry about the delta Covid variant.

"Although this bull market has laughed at nearly all the worry signs in 2021, let's not forget that September is historically the worst month of the year for stocks," said LPL Financial chief market strategist Ryan Detrick. "Even last year, in the face of a huge rally off the March 2020 lows, we saw a nearly 10% correction in the middle of September."

He added that any weakness could be short-term and contained in the 5% to 8% range.

"This bull market is alive and well and we would view any potential weakness as an opportunity," he said.

"first" - Google News

September 01, 2021 at 05:03AM

https://ift.tt/3DxihNd

S&P 500 closes flat on first day of September, Nasdaq ekes out a record close - CNBC

"first" - Google News

https://ift.tt/2QqCv4E

https://ift.tt/3bWWEYd

Bagikan Berita Ini

0 Response to "S&P 500 closes flat on first day of September, Nasdaq ekes out a record close - CNBC"

Post a Comment