If the state were to do nothing about its growing unfunded pension liability, it would be paying half a billion dollars out of the general fund in annual payments by 2038, even if it met its investment targets, a pension expert with the Legislative Joint Fiscal Office told the task force studying the problem Friday.

Chris Rupe offered the task force a detailed 41-page primer on the pension system, how it works and why unfunded liability has grown to nearly $3 billion — $5.6 billion, counting post-employment health benefits.

Meeting for the first time since the bill establishing its existence was signed into law, the 13-member Pension Benefits, Design, and Funding Task Force made Sen. Jeanette White, D-Windham, and Rep. Sarah Copeland Hanzas, D-Orange, its co-chairs. Rep. John Gannon, D-Windham 6, is also a member.

White and Copeland Hanzas, respectively the Senate and House chairs of the Government Operations Committee, welcomed the group and asked its members to be straightforward and honest in discussion and debate, and, in White’s words, “check partisan politics and preconceived notions at the door.” They thanked members for giving up a good part of their summer to work on the bill — and warned that it’s going to be a lot of work.

“I hope that everybody is willing to be really honest here and think and put our best efforts forward,” White said.

“If I didn’t have grave concerns about sustainability I wouldn’t have embarked on the task we started in January,” Copeland Hanzas, whose committee absorbed a good deal of the anger directed at the initial proposal, said. “I know it’s important to me and my constituents that a public pension benefit be available to our employees.”

The House Government Operations Committee produced an initial proposal in February seeking to control pension liability and annual payment costs by lowering benefit costs. It proved very unpopular with state employees, who were outraged that they were being asked to work longer and contribute more for lower benefits. That led the Legislature to instead focus on pension governance, and attempt the task force approach on a pension solution.

Members of the task force talked about their goals and what they hope to accomplish in the process of figuring out how to reduce the state’s unfunded liability, and its annual contributions to the system, to assure financial stability for the state and the pension funds.

Rep. Peter Fagan, R-Rutland 5-1, wants to know that money being invested in the pension will turn the situation around. Eric Davis, a teacher and member of the teachers’ retirement board, wants financial stability as well as a level of benefits adequate to recruit workers and provide effective services. Michael Clasen, the deputy state treasurer, offered hope that the task force’s work will lead to political courage in the leaders who will be asked to adopt the group’s work.

But Leona Watt, a representative of the Vermont State Employees Assocaition, put the task force’s work in context current events: The current shortage of corrections officers, and the stress that has caused. Indeed, VSEA leaders were scheduled to meet with Gov. Phil Scott on Friday morning to address the staffing crisis.

“You have people in corrections facilities right now already getting to leave or quitting,” Watt said. “The retirement benefit is a huge incentive to come into corrections — this is a hard job with no air conditioning.”

Whatever happens at the table, Watt said she hopes that the group takes the workers’ concerns and workers into consideration.

“I’m carrying on my back all the people who are represented in the state of Vermont. I want everybody … to feel they’ve been heard,” she said.

Copeland Hanzas spoke to that concern in a later comment.

“The timing of this conversation couldn’t be more difficulty when so many of our workforce are coming off the hardest working year and a half of their lives,” she said. “It makes me come to this conversation with a great deal of humility and compassion.”

The task force’s charge is a lengthy one. In addition to reducing actuarially defined employer contribution (ADEC) payments by between 25 and 100 percent, the task force has been asked to conduct a five-year review of benefit expenditures and employer and employee contribution growth rates. It’s been asked to limit ADEC growth to not more than the rate of inclination — a savings of up to — , and study the long-term impact of changes on retiree spending power as well as recruitment and retention.

It’s interim report is due Oct. 15 and the final report is to be submitted Dec.2

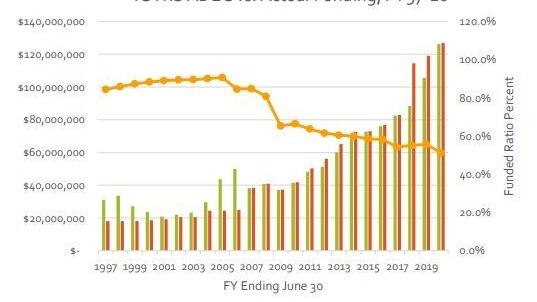

Unfunded liability in a defined benefit plan such as a pension, Rupe explained, is “not necessarily cause for alarm as long as it doesn’t create undue pressure on the budget.” But the lower the percentage of funding goes the more pressure it exerts on the budget, he said.

“The real risk is the funded ration get so low that it gets unaffordable to dig yourself out of the hole.”

And if the funds are paying out benefits at the same time, that means the fund must have more cash on hand available to pay those benefits to recipients. That means shorter-term investments, and the likelihood of sacrificing returns on investments for the sake of making those payments.

As of the past fiscal year, the state employees’ pension fund is sitting at 66 percent of funded liability while the teachers is at 51 percent. Fifteen years ago, Rupe said, both funds were close to fully funded.

What happened?

• It has taken longer than expected for the state’s pension investments to recover from the effects of the 2008 Great Recession.

• When the pension trustees lowered the assumed rate of return from 7.5 precent to 7.0 percent, the projections changed to match the more realistic anticipated returns.

• While nearly two decades of underfunding did have an impact on the teachers fund, it’s not the significant cause of the growth in unfunded liabilities or ADEC costs.

Actuarial assumptions about retirees were proven incorrect, as more of them stayed in the system until retirement age, and they are living longer past retirement.

The task force next meets in person on Wednesday in Montpelier.

"first" - Google News

July 03, 2021 at 04:26AM

https://ift.tt/3hbcGmA

Pension task force takes first look at a $5.6 billion problem - Bennington Banner

"first" - Google News

https://ift.tt/2QqCv4E

https://ift.tt/3bWWEYd

Bagikan Berita Ini

0 Response to "Pension task force takes first look at a $5.6 billion problem - Bennington Banner"

Post a Comment