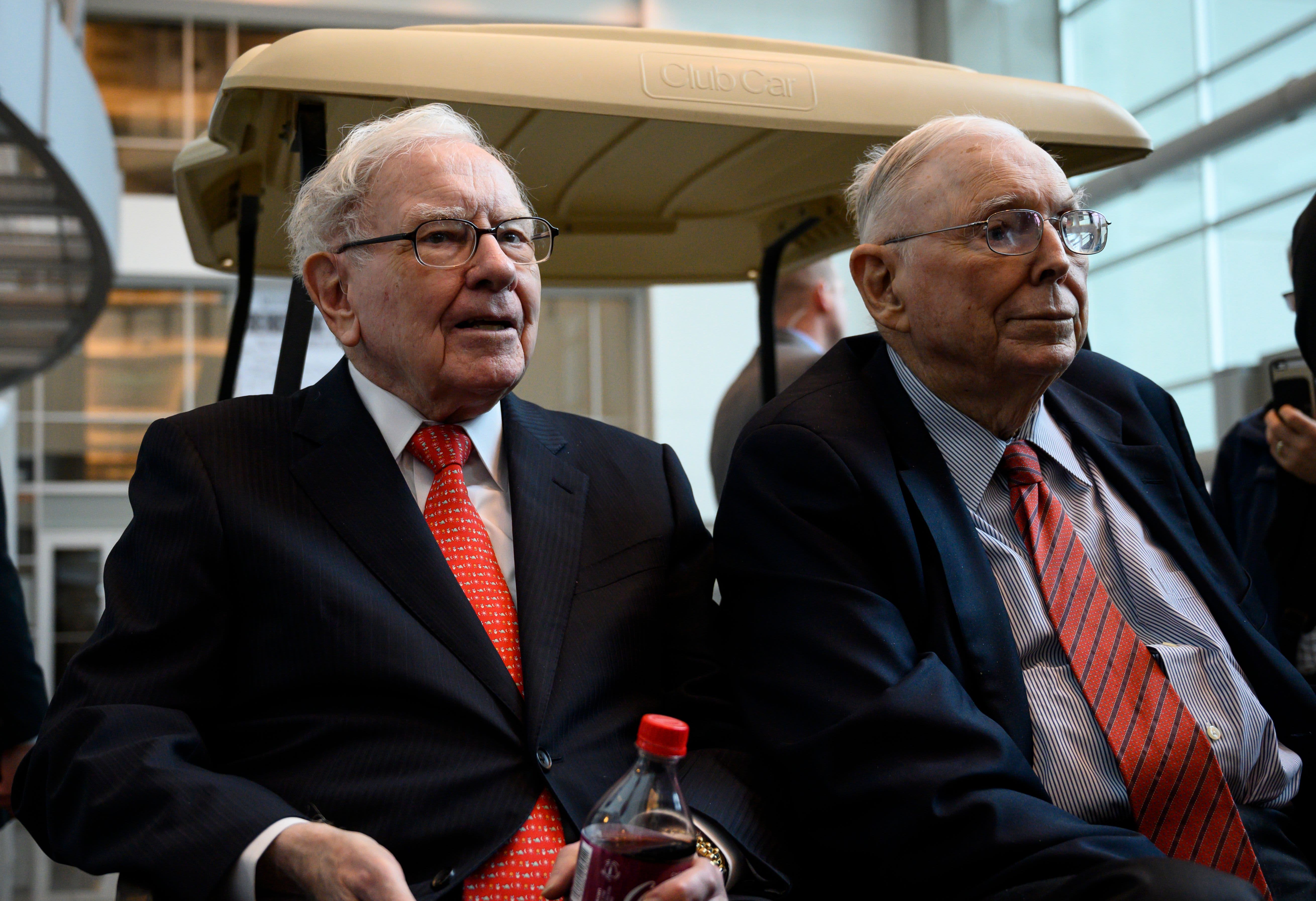

Before Warren Buffett and Charlie Munger became known as iconic business partners, steering the Berkshire Hathaway empire, they were just two guys from Omaha, Nebraska, who, apparently, were a lot a like.

They discovered that thanks to a well-known doctor in town, Dr. Edwin Davis, who told Buffett in a 1957 meeting he trusted him to manage money because the investor reminded him of someone named Charlie Munger.

"Well, I don't know who Charlie Munger is, but I like him," Buffett responded to Davis, the investing legend recalled in an interview with CNBC's Becky Quick, which aired Tuesday as part of a special, "Buffett & Munger: A Wealth of Wisdom."

Davis and his wife, Dorothy, made it a goal to eventually connect Buffett and Munger, Buffett said. It happened over dinner two years later, in 1959, when Munger, then a lawyer in Los Angeles, was back in Omaha after his father, Alfred, died.

"About five minutes into it, Charlie was sort of rolling on the floor laughing at his own jokes, which is exactly the same thing I did," Buffett, 90, said. "I thought, 'I'm not going to find another guy like this.' And we just hit it off."

"We got along fine," Munger, 97, said, adding: "What I like about Warren is the irreverence. We don't have automatic reverence for the pompous heads of all civilization."

Their friendship and business relationship blossomed from there, as Buffett continued building his investment firm and Munger toiled in law.

In the early 1960s, Munger said he finally heeded Buffett's advice about his career path. "It took me a long time to wise up that [Buffett] had a better way of making a living than I did. But he finally convinced me that I was wasting my time."

Munger started his own investment firm, which would go on to post an average annual compound rate of 19.8% between 1962 and 1975, far better than the Dow Jones Industrial Average's 5% over that span, according to Buffett's famous 1984 essay, "The Superinvestors of Graham-and-Doddsville."

Buffett said he remembers having long phone conversations with Munger back then. Added Munger: "We had fun in the early days because it was like hunting expeditions."

Buffett began to buy shares of Berkshire Hathaway in 1962, ultimately taking control of the company three years later and building it into the influential conglomerate it is today. He serves as chairman and CEO.

In 1978, Munger became vice chairman of Berkshire Hathaway, a position he still holds.

"I just knew instantly Charlie was the kind of guy that I was going to like, and I was going to learn from," Buffett said, reflecting on their initial meeting. "You know, it wasn't anything calculated, a decision or anything like that. It was natural. And we have had nothing but fun."

"first" - Google News

June 30, 2021 at 08:01AM

https://ift.tt/3h1WfZM

Buffett reflects on his first meeting with Munger: 'I'm not going to find another guy like this' - CNBC

"first" - Google News

https://ift.tt/2QqCv4E

https://ift.tt/3bWWEYd

Bagikan Berita Ini

0 Response to "Buffett reflects on his first meeting with Munger: 'I'm not going to find another guy like this' - CNBC"

Post a Comment