Allirajan M

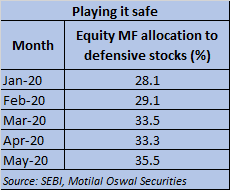

Equity mutual funds (MFs) are increasingly turning to safe investment options in order to shield their portfolios from the volatility and uncertainty caused by the COVID-19 pandemic. The weightage of shares of defensive sectors such as pharmaceuticals and fast-moving consumer goods (FMCG) increased 2.2 percentage points month-on-month (m-o-m) to hit an all-time high of 35.5 per cent in May.

Taking to defensives

The share of consumer non-durables (FMCG) in equity MF portfolios has surged to 9.21 per cent at the end of May compared to 7.77 per cent in January, data with markets regulator SEBI showed. With this, the sector has climbed to the third position (behind private sector banks and software firms) in the sectoral allocation of MFs.

related news

Fund houses are betting big on pharma companies. The allocation to pharmaceuticals in MF portfolios has jumped from 5.16 per cent in January to 7.72 per cent in May. The value of MF holdings in pharma companies soared 30.8 per cent during the timeframe to Rs 81574 crore, SEBI data showed.

MFs that invest exclusively in the shares of pharma companies are the best performers so far this year, having gained about 25.2 per cent in 2020. The BSE Healthcare index, which includes pharma firms, hit its 52-week high on June 24. After plunging in March, the BSE FMCG index has bounced back and is now trading close to levels seen in January.

“Since Covid-19 has caused a lot of uncertainty, fund managers are increasing allocations to businesses (such as pharma and FMCG) that have visibility (in revenues) in the near-term,” says Chandresh Nigam, managing director and CEO, Axis MF. “Businesses that are dependent on consumption at home are almost back to normal levels,” he says.

Insulated segments

“These sectors are showing lower de-growth compared to others. Fund houses are ramping up their exposure to defensives, as they are cash rich and are not stressed,” says a senior fund manager with a top fund house.

“Allocations to pharma have gone up. The resilience of these businesses to disruptions caused by the COVID-19 pandemic has been reasonably good,” says Kaustubh Belapurkar, director, fund research, Morningstar Investment Adviser India.

Most of India's leading pharma companies reported an increase in revenue ranging from high-single to mid-double digits, benefitting from the growth in the US and European markets and continued momentum in the domestic market, during the fourth quarter of 2019-20 (FY20).

“Many Indian pharma companies have focused on conserving cash through cost reductions and a prudent approach to capex (capital expenditure) and this has helped them to reduce debt,” Fitch Ratings said

“Most of the leading companies have a strong capital structure and we believe debt reduction in FY20 will further strengthen financial flexibility, particularly in 1HFY21 (first half of 2020-21) when we expect the (COVID-19) pandemic to have a moderate impact on profitability,” the agency said in its outlook.

Softening commodity prices and cost rationalisation measures would help in improving profit margins for FMCG companies, according to Deven R Choksey, managing director, KR Choksey Investment Managers.

The weightage of telecom stocks, another defensive bet, increased for the seventh consecutive month to hit a new high of 3.9 per cent in equity MF portfolios in May. The month also saw notable changes in sector and stock allocation of funds. On m-o-m basis, the weights of consumer, telecom, automobiles, healthcare, cement, technology, metals and utilities increased, while that of private sector banks, NBFCs (non-banking finance companies), public sector banks, oil and gas and retail firms moderated.

Incidentally, shares of FMCG and pharmaceutical companies were among those that recorded the highest increase in value during May. Stocks exhibiting maximum increase in value on a m-o-m basis were Hindustan Unilever (up Rs 6580 crore), ITC (increase of Rs 1890 crore), Aurobindo Pharma (up Rs 900 crore) and Cipla (increase of Rs 790 crore) Bharti Airtel’s market capitalisation increased by Rs 6140 crore during the month."load" - Google News

July 14, 2020 at 12:25PM

https://ift.tt/32azSKC

As markets go on the offensive, mutual funds load up on defensives - Moneycontrol.com

"load" - Google News

https://ift.tt/2SURvcJ

https://ift.tt/3bWWEYd

Bagikan Berita Ini

0 Response to "As markets go on the offensive, mutual funds load up on defensives - Moneycontrol.com"

Post a Comment